What Is The 2025 Fsa Contribution Limit

BlogWhat Is The 2025 Fsa Contribution Limit. The internal revenue service (irs) limits the total amount of money that you can contribute to a dependent care fsa. Dependent care fsa limits for 2025.

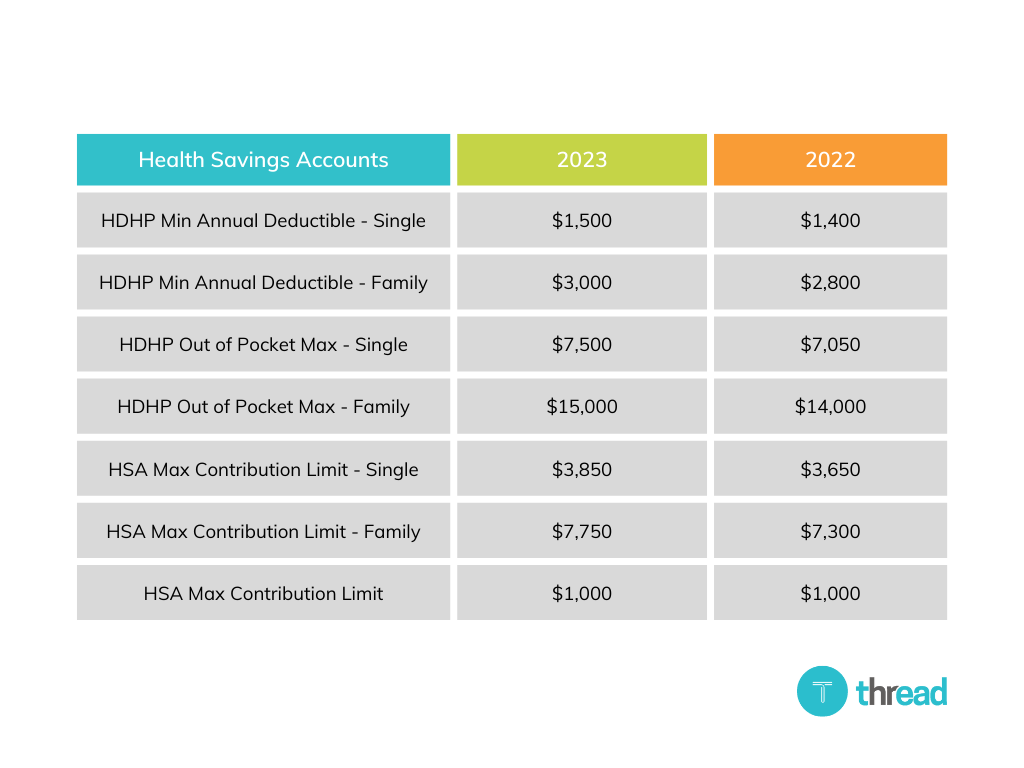

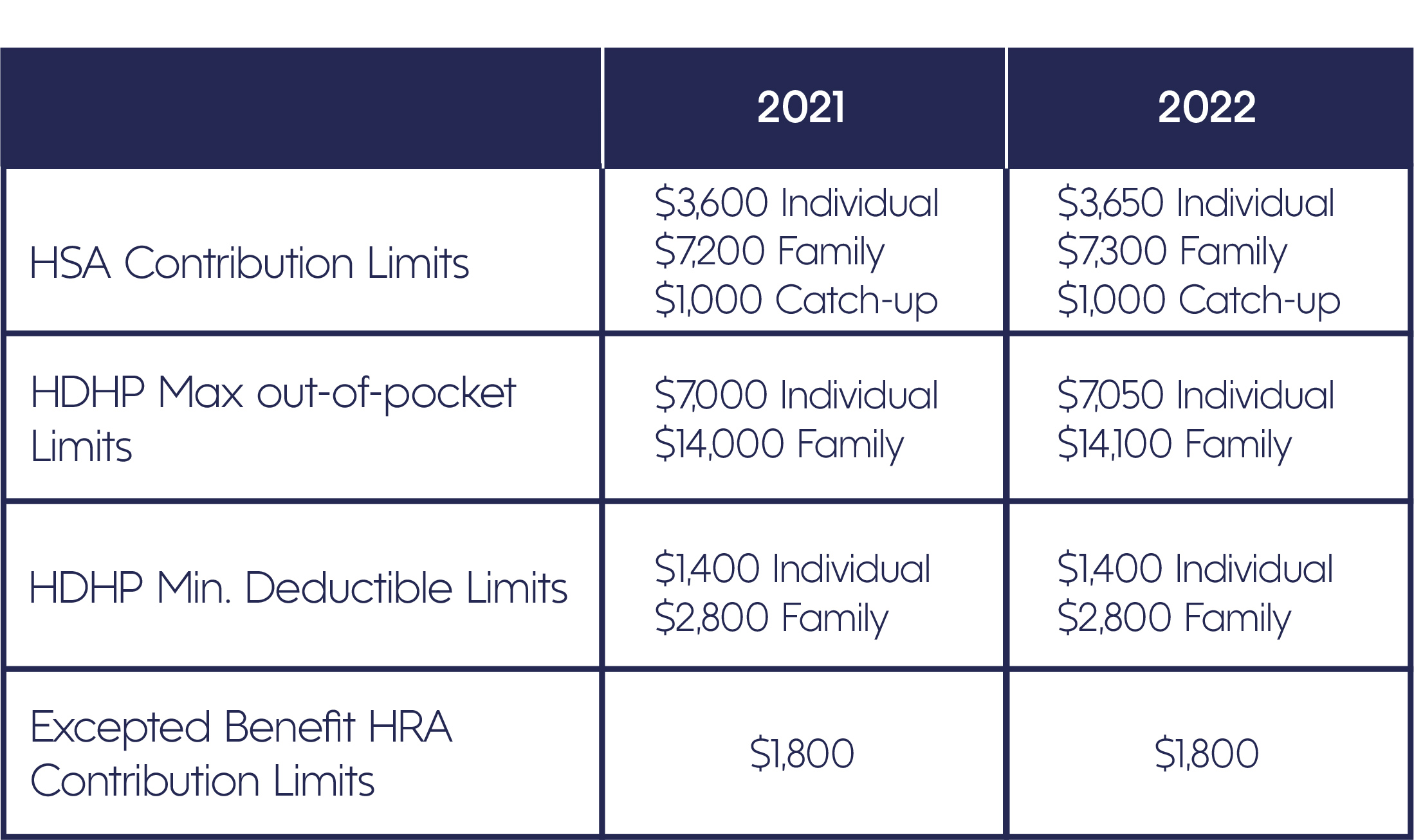

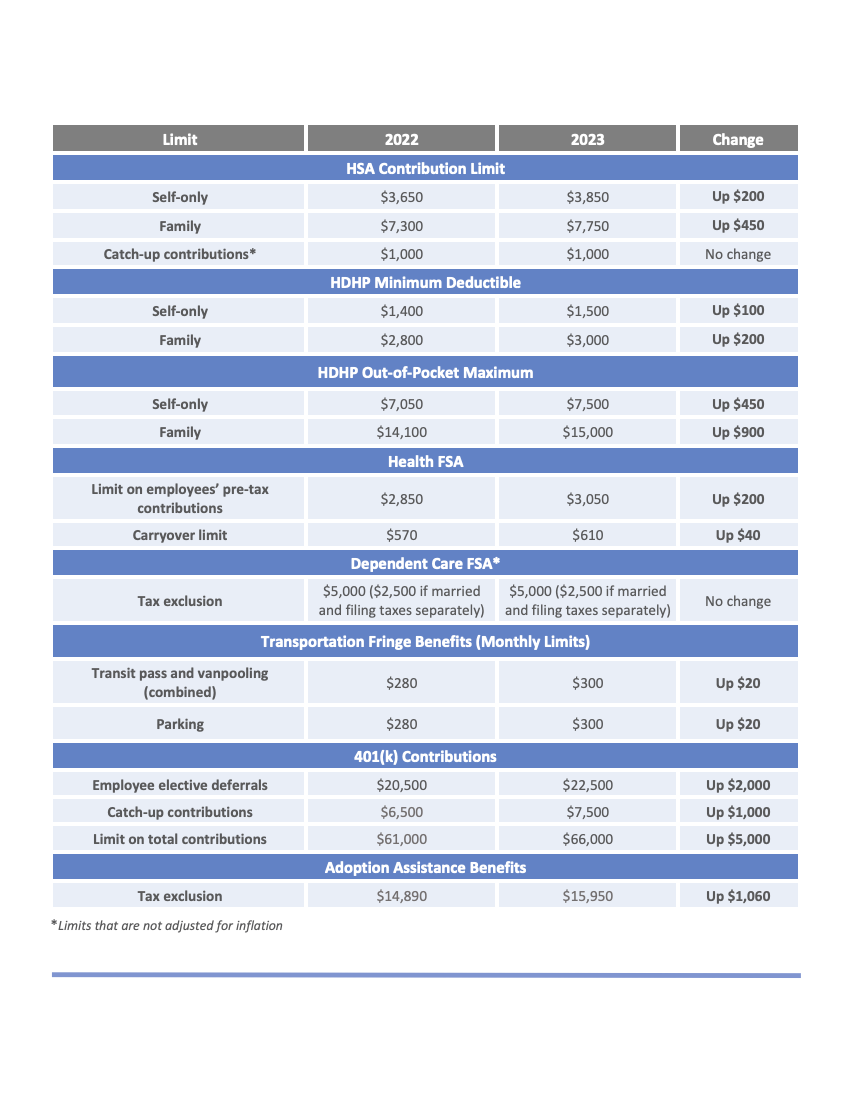

An employee who chooses to participate in an fsa can contribute up to $3,200 through payroll. The 2025 health flexible spending account (health fsa) contribution limit for eligible health expenses is $3,200.

2025 Fsa Contribution Limits Irs Babita Rosabella, The irs establishes the maximum fsa contribution limit each year based on inflation.

Fsa Limits 2025 Dependent Care Rania Catarina, A married employee’s dependent care fsa benefit limit is capped at the earned.

Annual Dependent Care Fsa Limit 2025 Over 65 Tessy Germaine, The 2025 contribution limit for limited purpose fsas is also $3,050 and $3,200 in 2025.

Fsa Employer Contribution Max 2025 Calendar Joete Madelin, For 2025, the health fsa contribution limit is $3,200, up from $3,050 in 2025.

2025 FSA, HSA, and commuter benefits contribution limits grow Navia, The fsa maximum contribution is the maximum amount.

IRS Makes Historical Increase to 2025 HSA Contribution Limits First, The irs establishes the maximum fsa contribution limit each year based on inflation.

Dependent Care Fsa Contribution Limit 2025 Over 55 Emlyn Iolande, An employee who chooses to participate in an fsa can contribute up to $3,200 through payroll deductions during the 2025 plan year.