Dependent Care Fsa Age Limit 2025

BlogFsa contribution limits 2025 dependent care. For 2025, as in 2025, the dependent care fsa limit is $5,000 for single filers and couples filing jointly, and $2,500 for married couples filing separately.

Amounts contributed are not subject to. It remains at $5,000 per household or $2,500 if married, filing separately.

Dependent care fsa limits for 2025 the 2025 dependent care fsa contribution limit is $5,000 for “single” or “married couples filing jointly” households.

Dependent Care FSA University of Colorado, Your child(ren) under age 13 You can use the dependent care fsa to pay for the day care of:

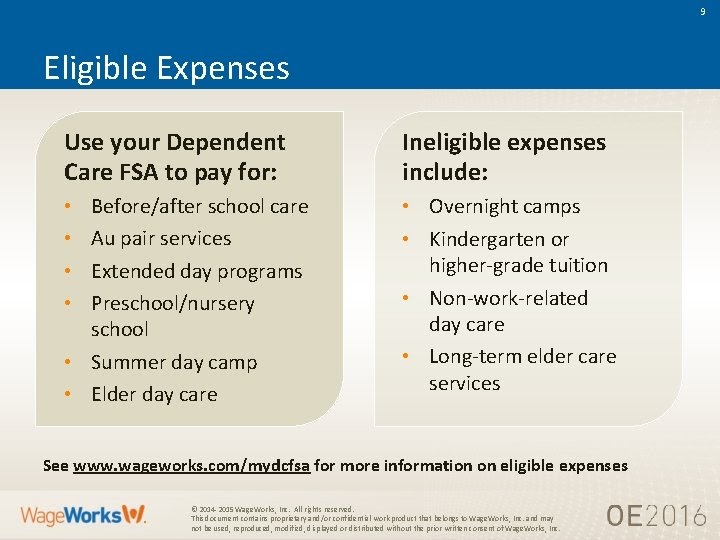

Fsa Approved List 2025 jaine ashleigh, Daycare, nursery school and preschool. The annual limit on employee contributions to a health fsa will be.

Under the Radar Tax Break for Working Parents The Dependent Care FSA, Your employer may set a limit lower than that set by the irs. Fsa contribution limits 2025 dependent care.

Everything you need to know about Dependent Care FSAs YouTube, This is unchanged from 2025. The amount goes down to $2,500 for married people filing separately.

HR Benefits Enroll for 2025 Dependent Care FSA!, You may be able to claim the credit if you pay someone to care for your dependent who is under age 13 or for your spouse or dependent who isn't able to care for themselves. This is an increase from the 2025 fsa contribution limit of $3,050.

Under the Radar Tax Break for Working Parents The Dependent Care FSA, Qualified dependent(s) for a dependent care fsa may include: The maximum annual contribution for a dependent care fsa — usually used for child or elder care — is $5,000 per household, or $2,500 if married and filing separately.

Dependent Care Flexible Spending Account (FSA) AwesomeFinTech Blog, What is a dependent care flexible spending account? The scheme can provide for the children of employees who are enrolled in the fsa program up until the child reaches the age of 13.

Dependent Care FSA YouTube, Your dependent care expenses must be for the care of one or more qualified dependent(s) but not for dependent health care expenses. Acp limits for 2025 addie anstice, dependent care fsa limits for 2025.

Wilhemina Howland, Dependent care flexible spending account overview. The amount goes down to $2,500 for married people filing separately.

health equity dependent care fsa OFF 73, For 2025, as in 2025, the dependent care fsa limit is $5,000 for single filers and couples filing jointly, and $2,500 for married couples filing separately. Irs dependent care fsa 2025 jayme loralie, you may first want to look at the recently released irs 2025 contribution limits.

A change in status (no longer being a student, or a child reaching the age limit) would also end eligibility.